- #QUICKBOOKS ENTERPRISE 2019 TUTORIAL UPGRADE#

- #QUICKBOOKS ENTERPRISE 2019 TUTORIAL PRO#

- #QUICKBOOKS ENTERPRISE 2019 TUTORIAL SOFTWARE#

- #QUICKBOOKS ENTERPRISE 2019 TUTORIAL WINDOWS#

You won't be able to sign up for live technical support or any other Intuit services that work with QuickBooks Desktop.

#QUICKBOOKS ENTERPRISE 2019 TUTORIAL SOFTWARE#

If you don't use QuickBooks Desktop 2019 add-on services, your software will continue to function normally. It includes QuickBooks Desktop Pro, Premier, and Enterprise Solutions v19 in all versions.

#QUICKBOOKS ENTERPRISE 2019 TUTORIAL WINDOWS#

You cannot access add-on services for QuickBooks Desktop for Windows 2019 after May 31, 2022. Let me share some insights about the discontinuation of QuickBooks Desktop 2019. Thank you for posting here in the Community, Dobbins. We had to revert and re-enter a week's worth of transactions. It was disastrous! Something to do with WebConnector.

#QUICKBOOKS ENTERPRISE 2019 TUTORIAL UPGRADE#

We tried to upgrade from 2019 to 2021 last year. To avoid interruptions to your service, purchase and register a supported version of QuickBooks. INTUIT WILL NOT BE RESPONSIBLE FOR ASSISTED PAYROLL TAX FORM FILINGS AFTER THE DISCONTINUATION DATE. YOUR PAYROLL TAX CALCULATIONS WILL BE INCORRECT, YOUR PAYROLL SUBSCRIPTION WILL BE DEACTIVATED, AND YOU WILL BE UNABLE TO SEND PAYROLL, INCLUDING DIRECT DEPOSTIT. If you do not upgrade to a more recent version of QuickBooks before you can expect: Payroll services are valid only when you are on a currently supported and registered version of QuickBooks. Today, we got a popup from inside the program that stated: If you'd like to take care of your transactions and lists, lay down the details below and I'll help you out. I'll address any other concerns you might have regarding the supportability for QuickBooks Desktop versions. Need to process your invoices for your customers? This article can guide you through the process: Create an invoice in QuickBooks Desktop.

#QUICKBOOKS ENTERPRISE 2019 TUTORIAL PRO#

If you're interested to upgrade to a newer version of QuickBooks, you can check this article for details on the process: Upgrade to newer versions of QuickBooks Desktop Pro Plus, Premier Plus, or Enterprise. This article can help you identify and handle those fake or phishing emails: Identify suspicious activity and phishing scams. If you're received an email that wants to click on unknown links or websites (regarding the incorrect discontinuation details), I'd recommend disregarding it to protect your account.

More details about the discontinuation can be found here: QuickBooks Desktop service discontinuation policy and upgrade information. However, updates and online services such as the Bank Feeds and payroll can no longer be used. You can still use the program after the discontinuation date. We are still supporting QuickBooks 2019 and above until further notice. We discontinued the services for QuickBooks 2018 (all editions) last May 31st, 2021. While the writer or editor may express a personal opinion within this article regarding this feature and/or the software as a whole, such personal opinion does not constitute a formal endorsement by Insightful Accountant or the publisher.I'll clarify the details about QuickBooks' discontinuation and supportability. This article is intended to serve as a summary of one specific QuickBooks 2019 product features, it is not an in-depth review nor has it been written to provide instruction in the proper use of the software (or feature). Be aware that certain aspects of features described or illustrated herein may have changed between the pre-release software version we used and the release of QuickBooks 2019 desktop products scheduled for September 4, 2018.

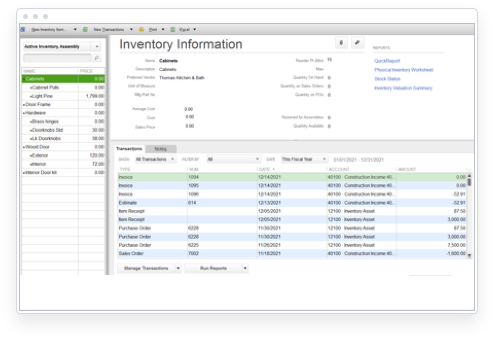

Graphics or other illustrations used in this article have either been prepared using a pre-release version of QuickBooks 2019 software, or were furnished and/or adapted from Intuit source content. I’m personally excited about this new functionality because it allows for significant file size reductions without impacting the transactional history of the file, or without requiring summary transactions to keep balances intact. That makes perfect sense, a file with more entries in the Audit Trail resulting from transactional edits has more removable audit trail data, which represents a larger percentage of file size as a whole. It reduced this sample file size by 47% going from 36 MB to 19 MB without disrupting any transaction or list data.īased upon my testing with several different Company files ranging from 300 MB to 1.2 GB the file sizes were reduced between 31- and 49-percent. In reviewing the Audit Trails of each file prior to reduction, it appears that files that have a history of a lot of changes to transactions were impacted more significantly by this new process than files with fewer transactional edits. In this example, you can see that this new feature did a great job.

0 kommentar(er)

0 kommentar(er)